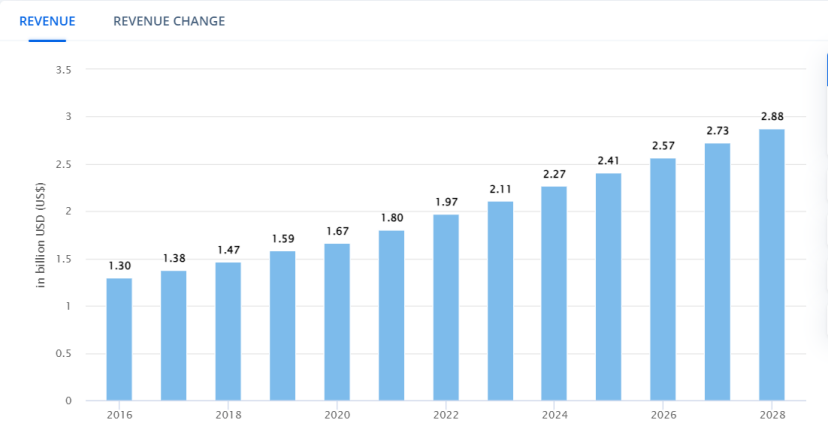

According to publicly available data, the revenue of the Southeast Asian vitamin and mineral market is projected to reach USD 2.27 billion in 2024, with a continued expansion at a compound annual growth rate of 6.13%. This significant growth is mainly attributed to shifts in local consumer preferences, emerging market trends, and specific circumstances.

In Southeast Asia, consumers' health awareness is steadily increasing, accompanied by the gradual rise in local economic growth and consumer purchasing power. People are increasingly recognizing the importance of nutrition for overall health and are choosing vitamins and minerals as essential nutrients to maintain their health.

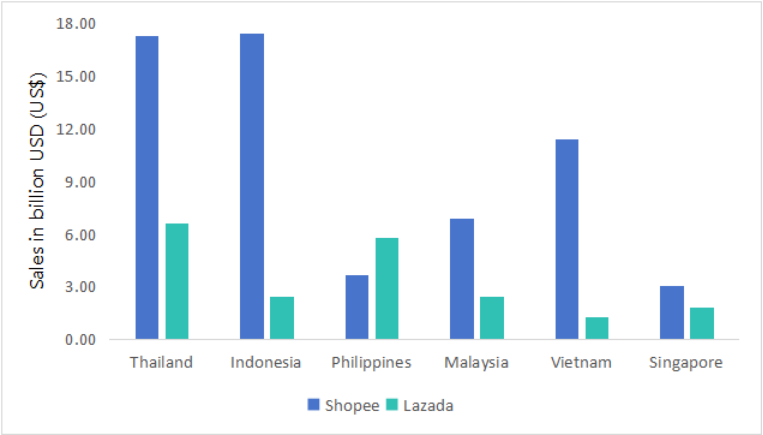

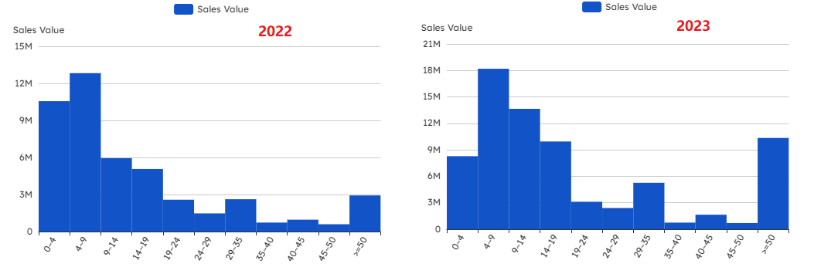

Additionally, Southeast Asia's large middle-class population and aging trend have also created a broad market base for health supplements. Against the backdrop of rapid market development, the scale of health supplements on Southeast Asian online platforms is also expanding gradually. According to data from Moojing Oversea, in 2023, sales of health supplements on Southeast Asian e-commerce platforms (Shopee and Lazada) reached USD 1.764 billion, an increase of over 25% compared to 2022.

The competition in Southeast Asia's health supplement market is intensifying. Brands wishing to carve out a share of this market must fully understand market demands, grasp the market environments in different countries, and consumer preferences. Continuous market monitoring and in-depth research will help companies grasp market trends, and make timely product updates and strategic adjustments, thereby standing out in the fiercely competitive market.

Situated in the tropical region, Southeast Asia experiences hot climates throughout the year, profoundly influencing local consumers' purchasing decisions. Apart from intense sun exposure, Thailand also grapples with severe air pollution, leading to common issues such as acne, dark spots, freckles, and sensitive skin among its populace.

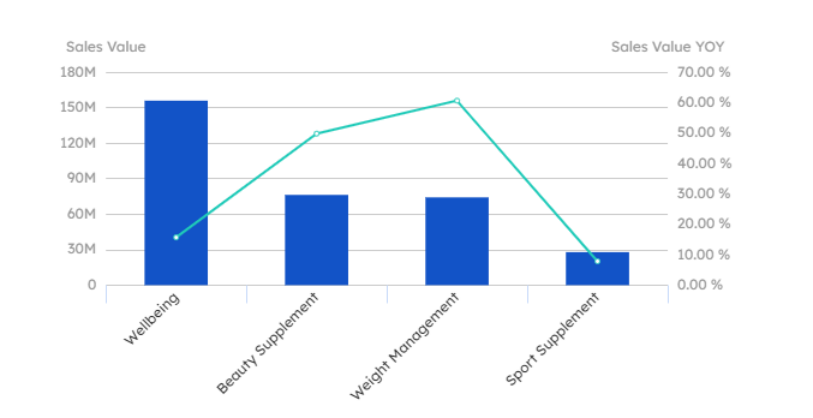

According to data from Moojing Oversea, the market for beauty and weight management supplements on Thailand's Shopee platform witnessed a growth of over 50% in 2023. The pursuit of health and beauty by female users has been a driving force behind the development of the local health supplement industry.

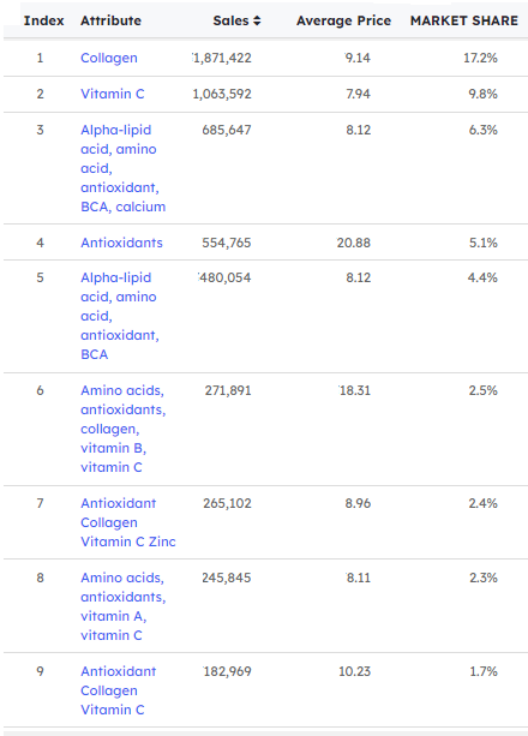

In the realm of beauty supplements, skin nutrition supplements dominated with a yearly sales revenue of 70.8 million USD, capturing an 82.6% market share and experiencing a 41% year-on-year growth. Key ingredients that Thai consumers are particularly attentive to include collagen, vitamin C, and antioxidants, reflecting their core desire to delay aging and maintain youthful skin.

Weight supplements are divided into two main categories: "weight loss" and "muscle gain." Among them, the "weight loss" functional supplements, which are most favored by Thai consumers, occupy a 72% market share and achieved a remarkable 103% high-speed growth in 2023.

This issue focuses on nutritional supplements in Thailand, seizing consumers' demand for functionality. In the next Post of SEA health product introduction, we will delve into the impact of consumers' preferences for ingredients and dosage forms on the market in Indonesia and the Philippines. Understanding consumers' needs makes it easier to achieve success in the market